2023 Columbia Market Snapshot

In the ever-evolving landscape of commercial real estate, Columbia, South Carolina emerges as a focal point of dynamic trends and opportunities. As we step into the first month of 2024, the stage is set for a compelling Market Snapshot, capturing the essence of the past year. Keep reading as we navigate the nuances of Columbia’s commercial real estate market, providing valuable insights for investors, developers, and stakeholders eager to stay ahead in this thriving urban environment.

Office Market

Vacancy rates slightly increased from 9.1% in 2022 to 9.4% in 2023. Rental rates remained steady from 2022 through 2023 with the average rate being $18.70/SF respectively.

In 2023, office properties sold for an average price of $107/SF which is a decrease from the 2022 average sales price of $122/SF. On average, Cap rates decreased for office investment properties from 7.5% in 2022 to 6.8% in 2023. Cap rates ranged from 9.2 – 5.57% in 2023.

Office Properties

Class A Properties sold for an average price of $325/SF

Class B Properties sold for an average price of $123/SF

Class C Properties sold for and average price of $110/SF

Retail Market

Vacancy rates decreased slightly from 4.1% in 2022 to 3.6% in 2023. On average, rental rates increased from $14.99/SF in 2022 to $15.76/SF in 2023 respectively.

In 2023, retail properties sold for an average price of $138/SF which is a decrease from the 2022 average sales price of $147/SF. On average, Cap rates remained the same from 2022 through 2023 for retail investment properties at 6.5%. Cap rates ranged from 12.5% to 4.25% in 2023.

Retail Properties

Class A Properties sold for an average price of $289/SF

Class B Properties sold for an average price of $163/SF

Class C Properties sold for and average price of $134/SF

Industrial/Flex Market

Over the last year, vacancy rates remained steady at 5% for industrial properties and decreased from 4.4% in 2022 to 2.9% in 2023 for flex properties. Average rental rates, for industrial properties, increased from $4.45/SF in 2022 to $5.35/SF in 2023 and average rental rates remained relatively the same over the last year for flex properties at $9.63/SF.

In 2023, industrial and flex properties sold for an average price of $75/SF which is an increase from the 2022 average sales price of $70/SF. On average, Cap rates increased for Industrial and Flex properties from 6.25% in 2022 to 7.1% 2023. Cap rates ranged from 5.76% to 10% in 2023.

Flex Properties

Class A Properties sold for an average price of $91/SF

Class B Properties sold for an average price of $77/SF

Class C Properties sold for and average price of $63/SF

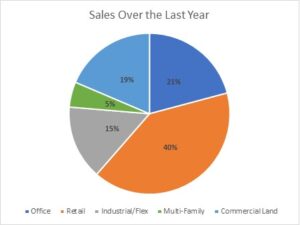

Sales Over The Past Year

If you’re struggling to increase occupancy or are having a hard time finding quality tenants for your investment property, allow us to solve that problem for you. We thoroughly screen all prospective tenants to ensure that they will be a good fit for your property. Our screenings include credit reporting, prior criminal activity, eviction history, and personal financial statement review.

CRE investors are actively looking to purchase real estate in our market. If you’re looking to purchase or sell a commercial asset in Columbia, we would love to guide you through that process. Contact us for a complimentary broker opinion of value for your asset and a detailed marketing plan.

Whatever your real estate needs are, we’re here to help.

We look forward to connecting with you soon!